THOR Calculator

THOR Calculator

THOR Calculator is a tool for calculating the compounded THOR for a specified period1/ . The period can be specified as “Observation period” or “Interest period”. To calculate the compounded THOR for a specified “Interest Period”, backward shift convention will be applied.

observation period

Remark

- 1/ Compounded THOR for a specific period of time is calculated by compounding the daily values of THOR which will use compound average method for business days and use simple average method for non-business days.

-

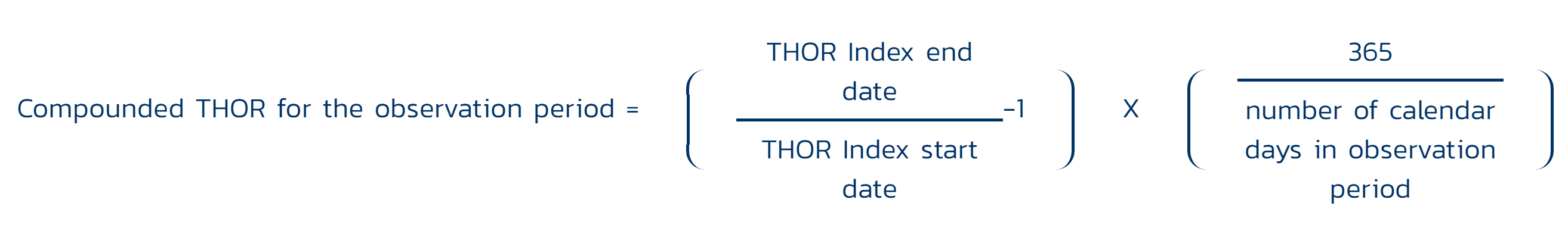

2/ Compounded THOR for the observation period can be calculated from the following THOR Index formula

For example, if the start date and end date of the observation period are 1st and 30th April 2020 respectively, THOR Index as of 1st and 30th April 2020 are inputs in the formula. The result equals to compounding the daily value of THOR from 1st to 29th April 2020 because THOR Index of any specific date is calculated by compounding the daily value of THOR from the first publication date to the value of the day before that specific date.

Disclaimer

- “Compounded THOR for the observation period” is used for indicative purposes only. The value used in the contract may be different depending on details in the contract.

Interest period

Remark

- 1/ Compounded THOR for a specific period of time is calculated by compounding the daily values of THOR which will use compound average method for business days and use simple average method for non-business days.

-

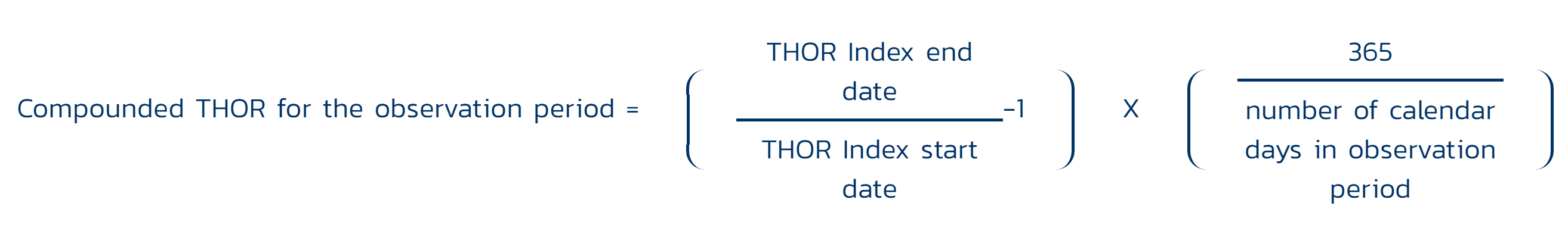

2/ Compounded THOR for the observation period can be calculated from THOR Index in the following formula

For example, if start date and end date of the observation period are 1st and 30th April 2020 respectively, THOR Index as of 1st and 30th April 2020 are inputs in the formula. The result equals to compounding the daily value of THOR from 1st to 29th April 2020 because THOR Index of any specific date is calculated by compounding the daily value of THOR from the first publication date to the value of the day before that specific date.

- 3/ Business day convention is a method to adjust the start date and end date of interest period when these days fall on non-business days. The five methods are as follows:

- (1) Unadjusted: the start date and end date of interest period can fall on non-business days.

- (2) Following: if the start date or end date of interest period is a non-business day, that day will shift to the next business day.

- (3) Modified following: if the start date or end date of interest period is a non-business day, that day will shift to the next business day. However, if the next business day falls on the following month, the start date or end date will shift to the previous business day.

- (4) Preceding: if the start date or end date of interest period is a non-business day, that day will shift to the previous business day.

- (5) Modified preceding: if the start date or end date of interest period is a non-business day, that day will shift to the previous business day. However, if the previous business day falls on the previous month, the start date or end date will shift to the next business day.

- 4/ “Backward shift” convention is a means to identify the observation period. Applying the number of business day(s) backward shift to both the start date and the end date of interest period will result in the “observation period”.

Disclaimer

- “Compounded THOR for the observation period” and “Interest payment” are used for indicative purposes only. The value used in the contract may be different depending on details in the contract.